First Class Info About How To Settle Debt With The Irs

You can work with a tax debt resolution service or you can try to file on your own.

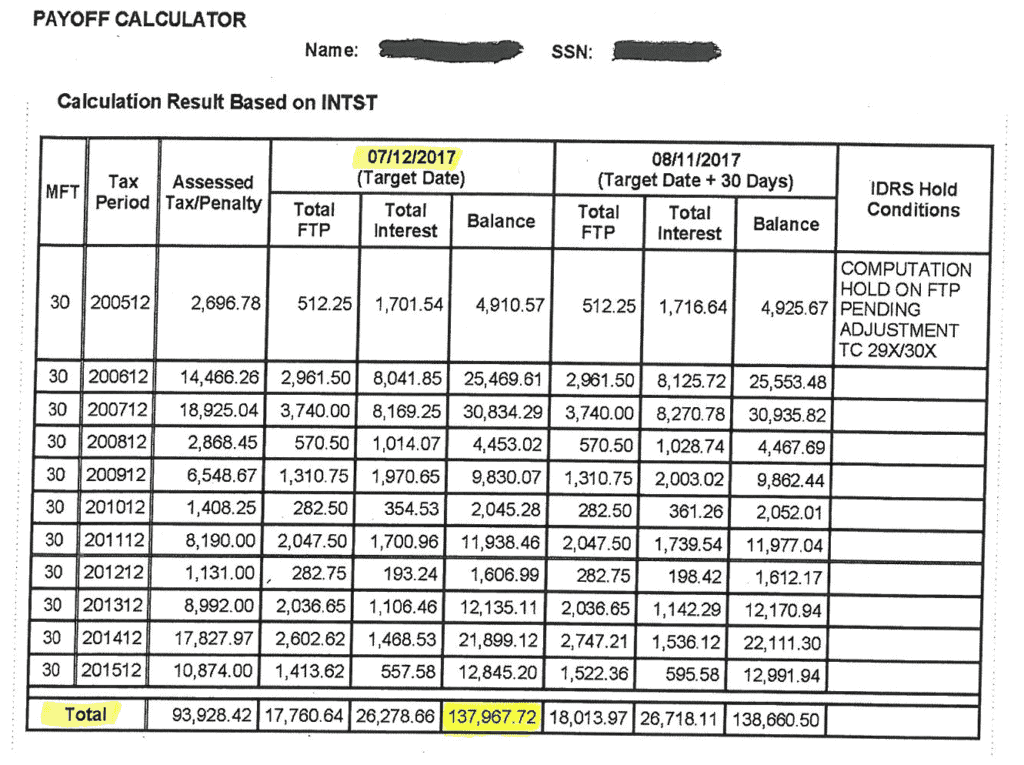

How to settle debt with the irs. Get your no obligation analysis with qualification options In principal, settling with the irs is like settling with any other creditor: As a rule of thumb, if your debt is less than $10,000, it’s usually best to contact the irs yourself to try to arrive at a payment agreement.

The longer you ignore your debt, the bigger the monster that this tax debt will become. How to settle your tax debt settling your irs tax debt is no simple process. The ‘offer in comprise’ is a settlement.

You can repay the irs through monthly payments. How much does the irs usually settle for? Offer in compromise partial payment installment.

Ad check your eligibility for various programs to resolve tax problems. If the irs accepts your offer, you would then pay the rest of the offer amount in 5 or fewer installments. Provide tax relief to individuals and families through convenient referrals.

Get free, competing quotes from leading irs tax negotiation experts. This will help you understand what the irs can and can’t do to collect your debt. To settle your tax debt with the irs without paying the full amount, you need to sign an ‘offer in compromise.’ offer in compromise.

There are a few ways to settle your tax debt by yourself such as: Free, competing quotes from irs tax negotiation experts. It has tighter eligibility rules and a longer list of qualifications than the irs’ other.

An offer in compromise is one of the multiple payment options the irs offers to taxpayers. Ad end your irs tax problems. There are companies promising things they cannot deliver.

Free case review, begin online. How to settle tax debt yourself you have two options to file an offer in compromise. Getting an offer in compromise (settling the debt by paying less than you owe) considering your payment plan.

Settlements can take up to a year however. Offer in compromise — certain taxpayers qualify to settle their tax bill for less than the amount they owe by submitting an offer in compromise. To qualify, you will have to demonstrate that the tax.

The irs debt settlement options the irs offers a few different debt settlement options for unpaid taxes. You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal. Basically, the irs decreases the tax.