Looking Good Tips About How To Buy A Call Spread

/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-01-def4a17c8b054eba9f90189fc30bf002.jpg)

A calendar or horizontal call spread is created.

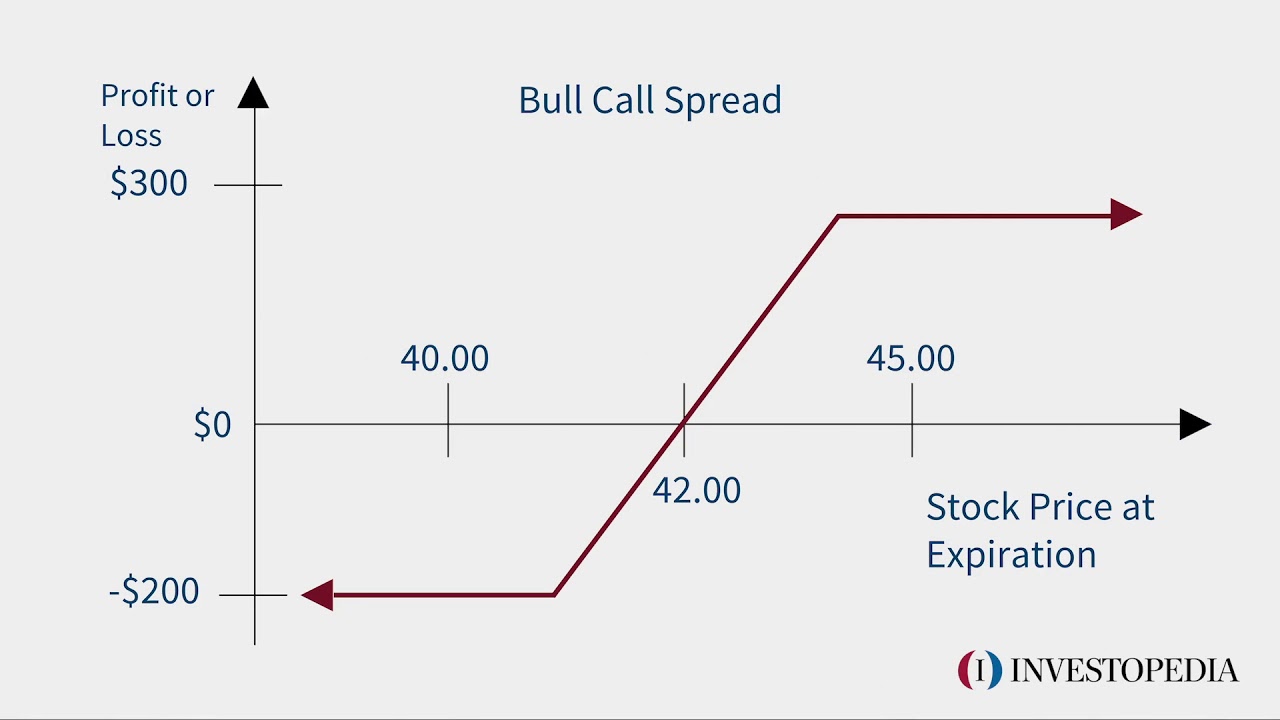

How to buy a call spread. A call debit spread is a bullish options strategy that involves buying a call option and selling a further strike call option. To close a short call spread, you need to buy back the short call and sell the long call. Simply put, the market is implying a theoretical edge of 11.3%.

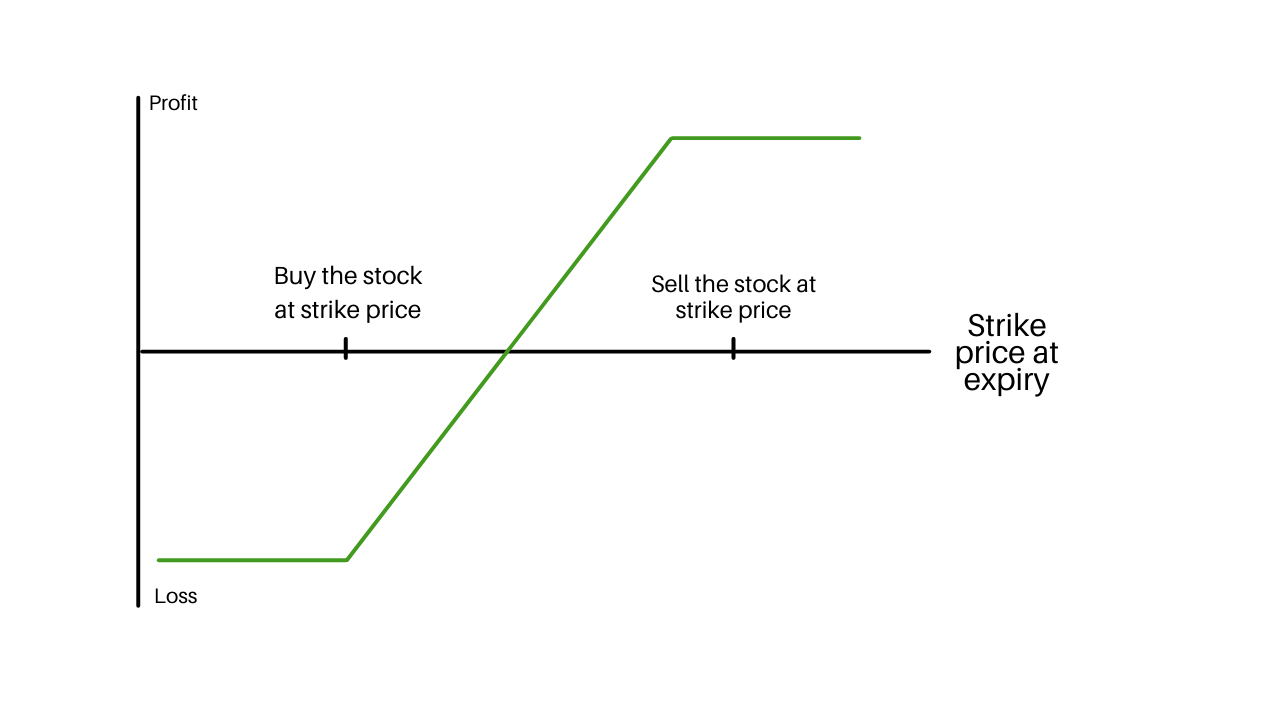

Reasons to like this trade. Your maximum risk is the amount required to secure the trade and is equivalent to the buy. What is a bull call spread?

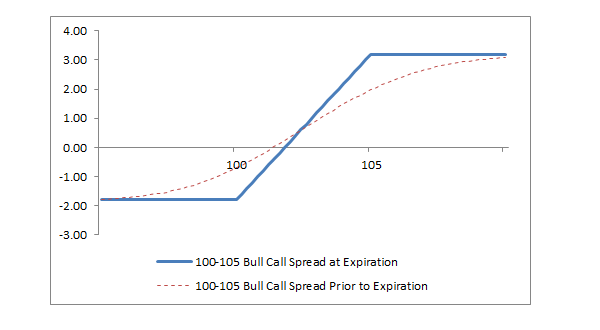

Bull call debit spreads can be hedged if the underlying stock's price has decreased. A debit is paid for the long call, and a smaller credit is. An options trader can use a bear call spread by purchasing one call option contract with a strike price of $40 and a cost/premium of $0.50 ($0.50 * 100 shares/contract =.

In this trade, that would mean buying back the short 142 call and selling the long 145 call. If xyz plc stock rises and is. An options trader executes buying a call spread by buying a 420 call at 17 and selling a 460 call at 6.

Understanding a bull call spread choose the asset you believe will experience a slight appreciation over a set period of time (days, weeks, or months). Buy one us 500 call spread contract with a range of 3355.00 to 3395.00 at a price of 3358.10. To profit from changes in implied volatility and from time decay, use a calendar call spread.

You can buy this spread for $1.90 when theoretically it’s worth $2.11. To hedge the bull call spread, purchase a bear put debit spread at the same strike price and expiration as the. Buy a call option for a.

A bull call spread, which is an options strategy, is utilized by an investor when he believes a stock will exhibit a moderate increase in price. They are financial instruments that allow you to speculate on markets, without taking ownership of underlying assets.

:max_bytes(150000):strip_icc():gifv()/bullcall-spread-4200210-01-final-1-c25c02e4928f4e4e96ceb7ac85cf8922.png)

/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-01-def4a17c8b054eba9f90189fc30bf002.jpg)